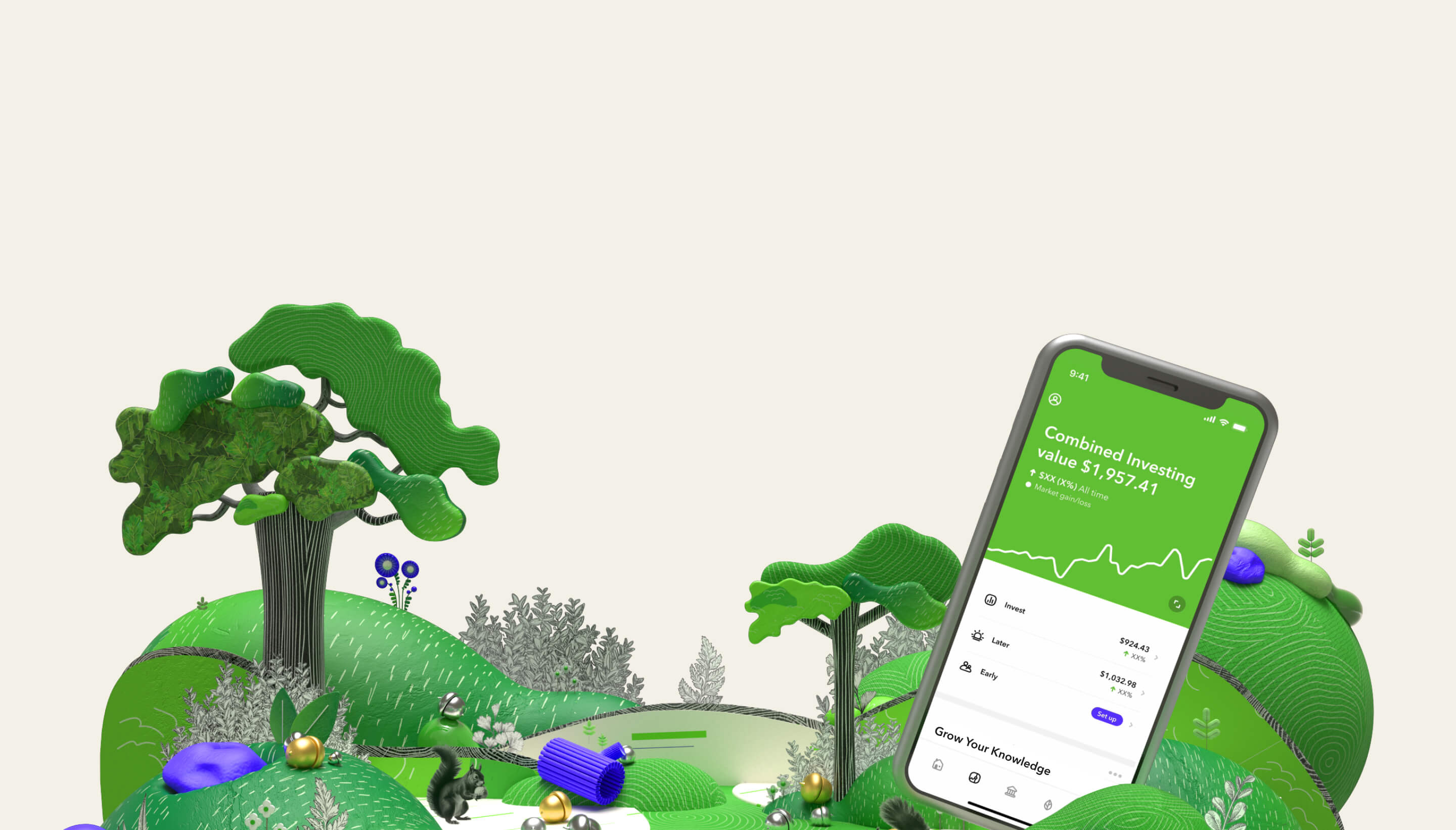

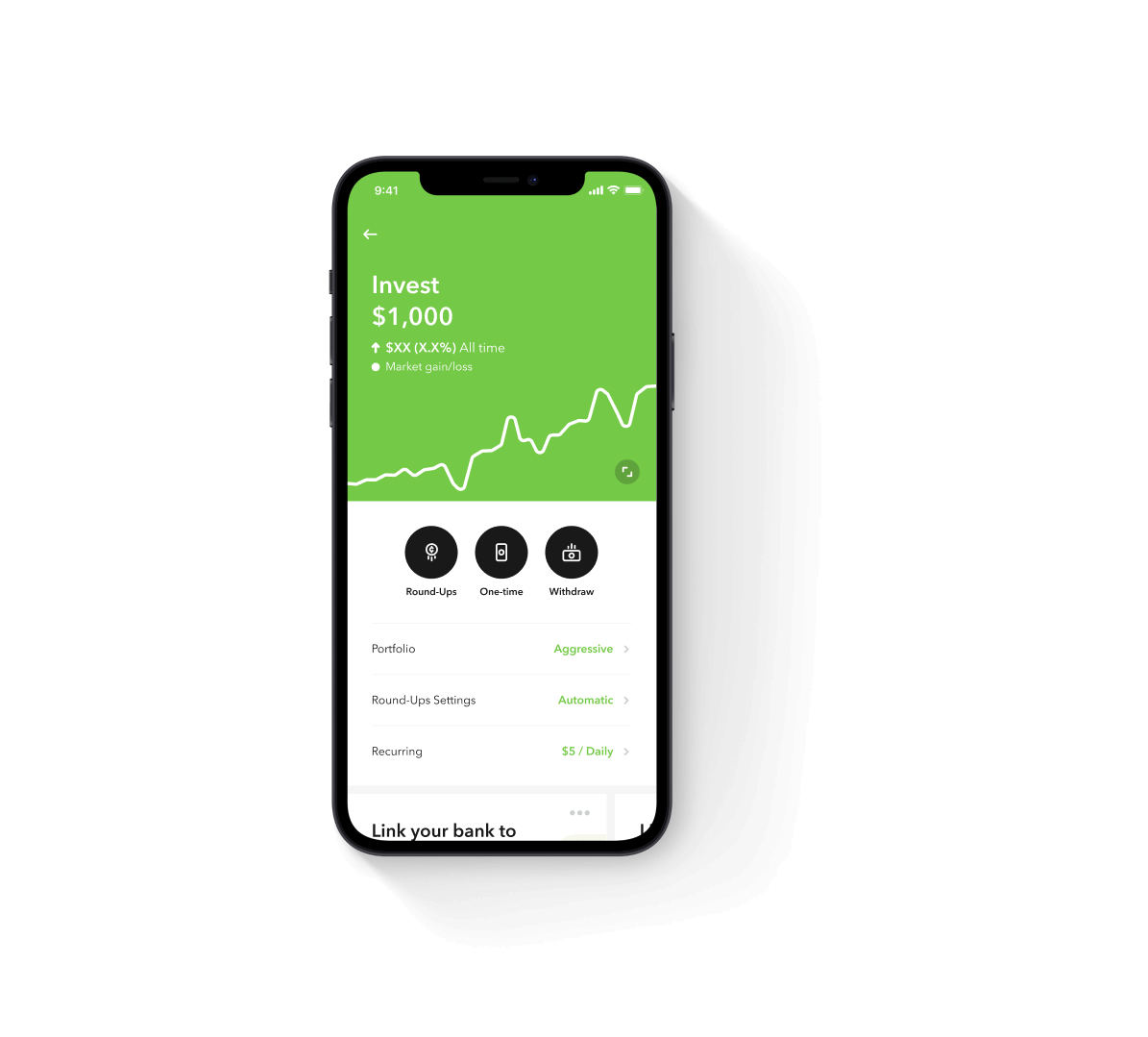

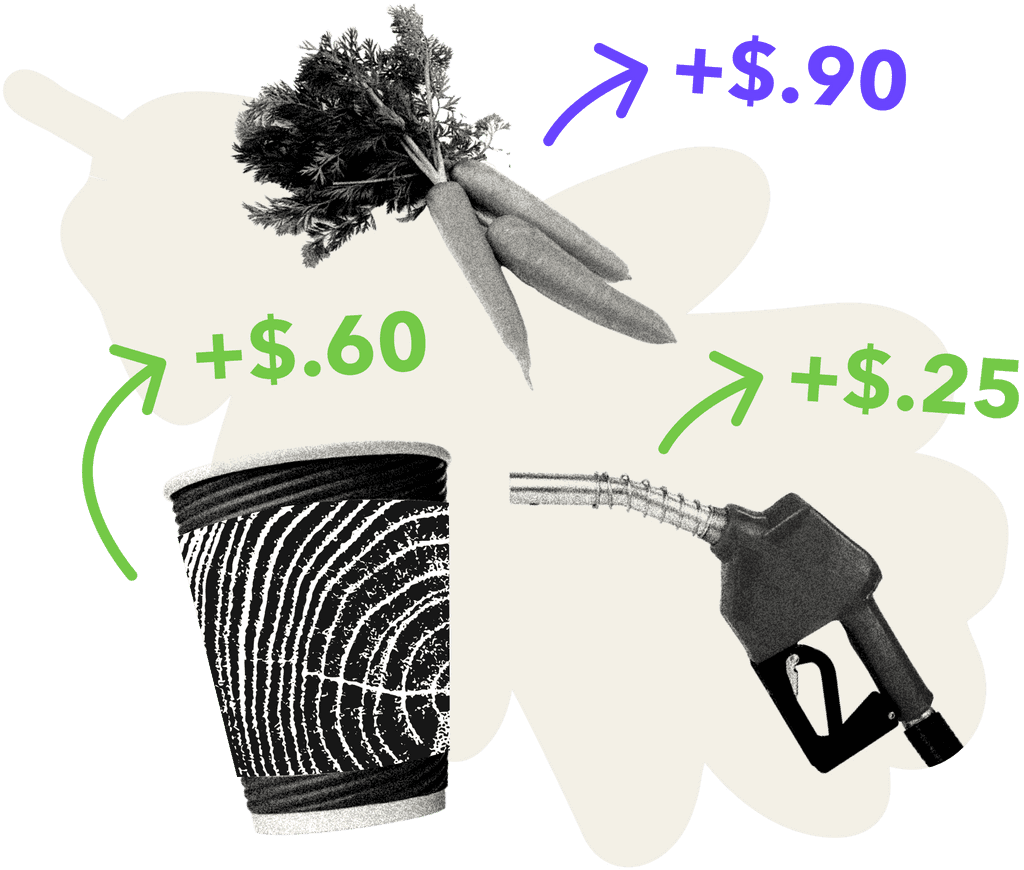

Every purchase you make means an opportunity to invest your spare change! So coffee for $3.25 becomes a $0.75 investment in your future.

Acorns diversified portfolios are built by experts and include ETFs managed by pros at the world’s top investment firms like Vanguard and BlackRock.

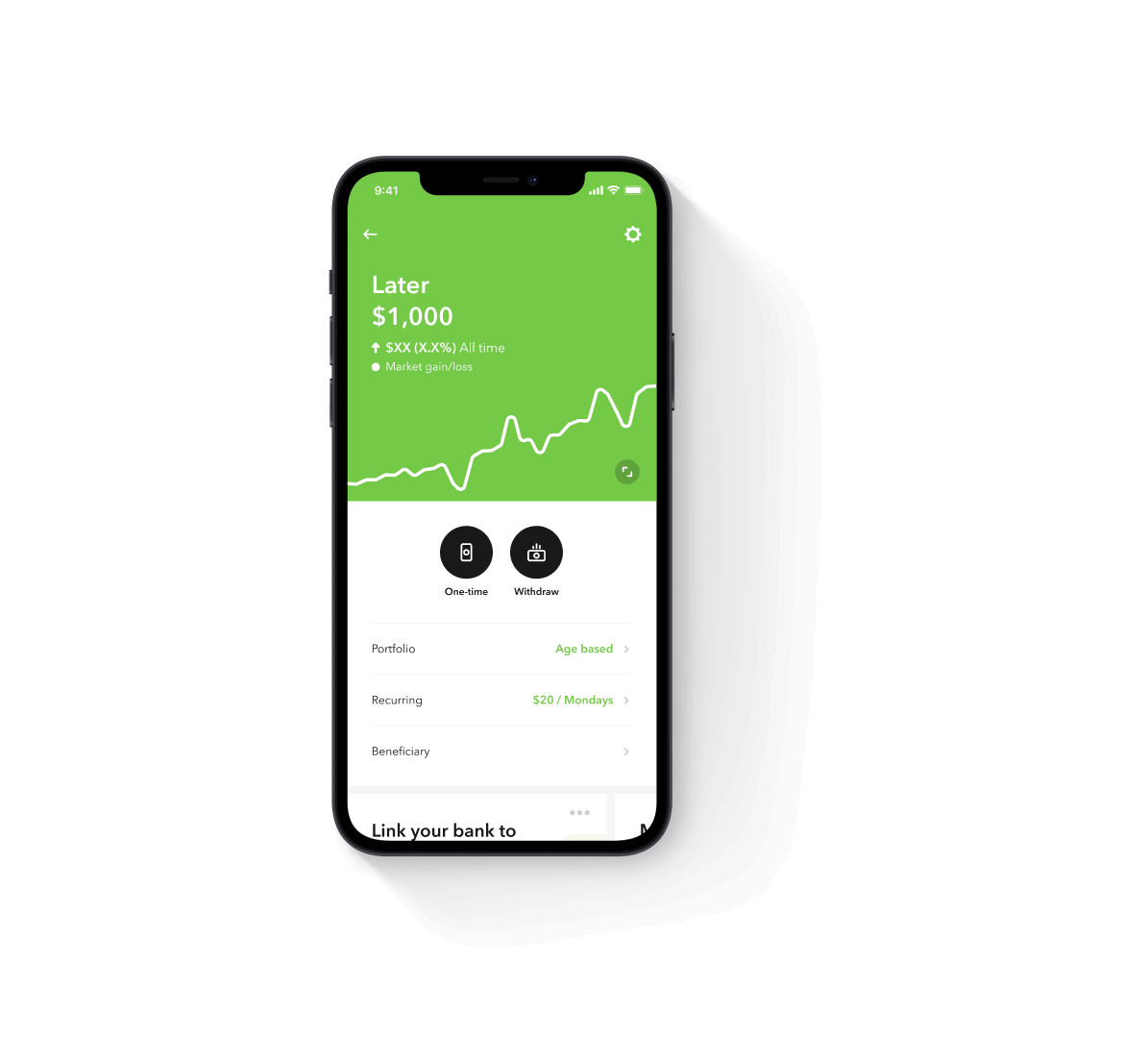

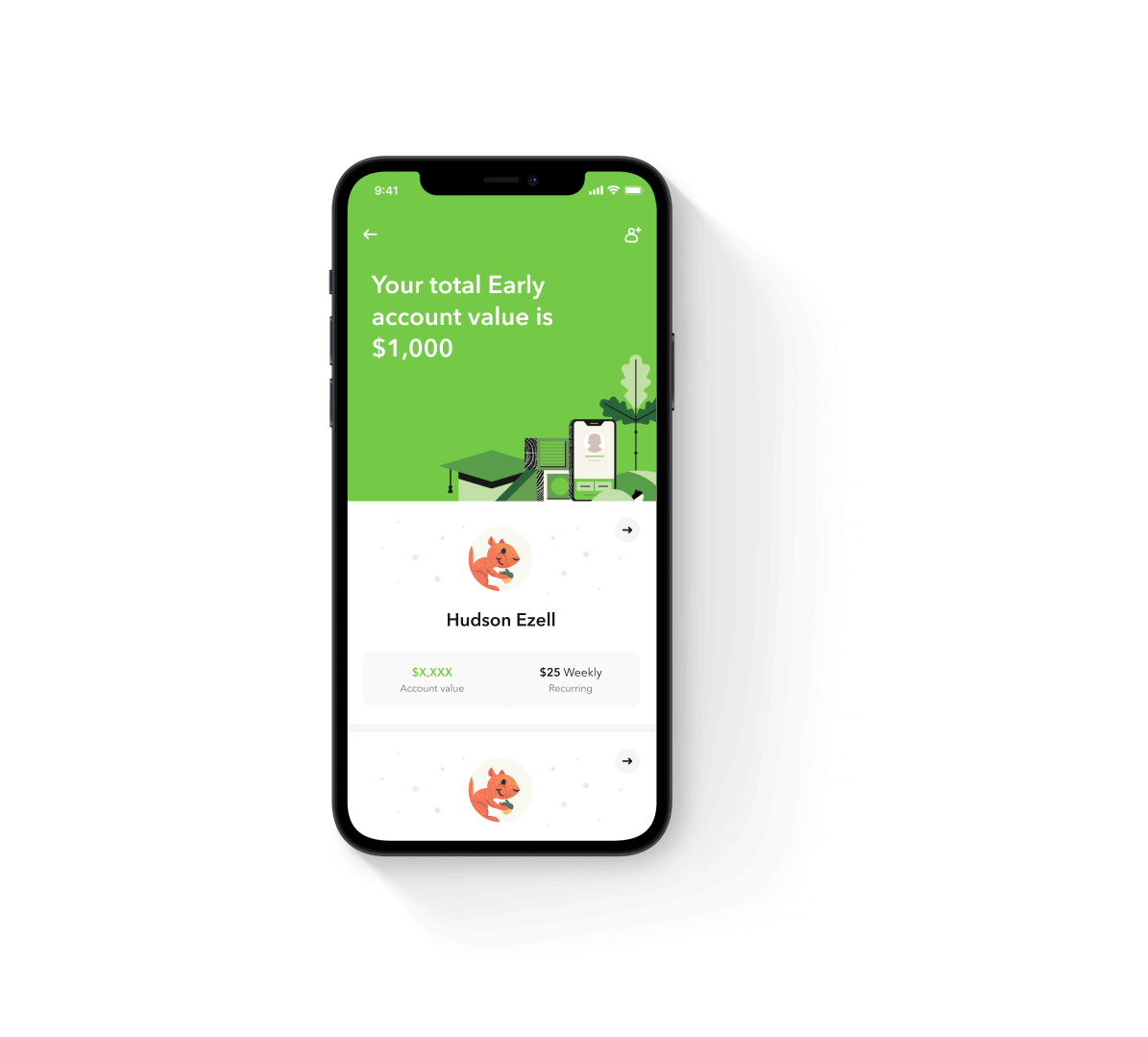

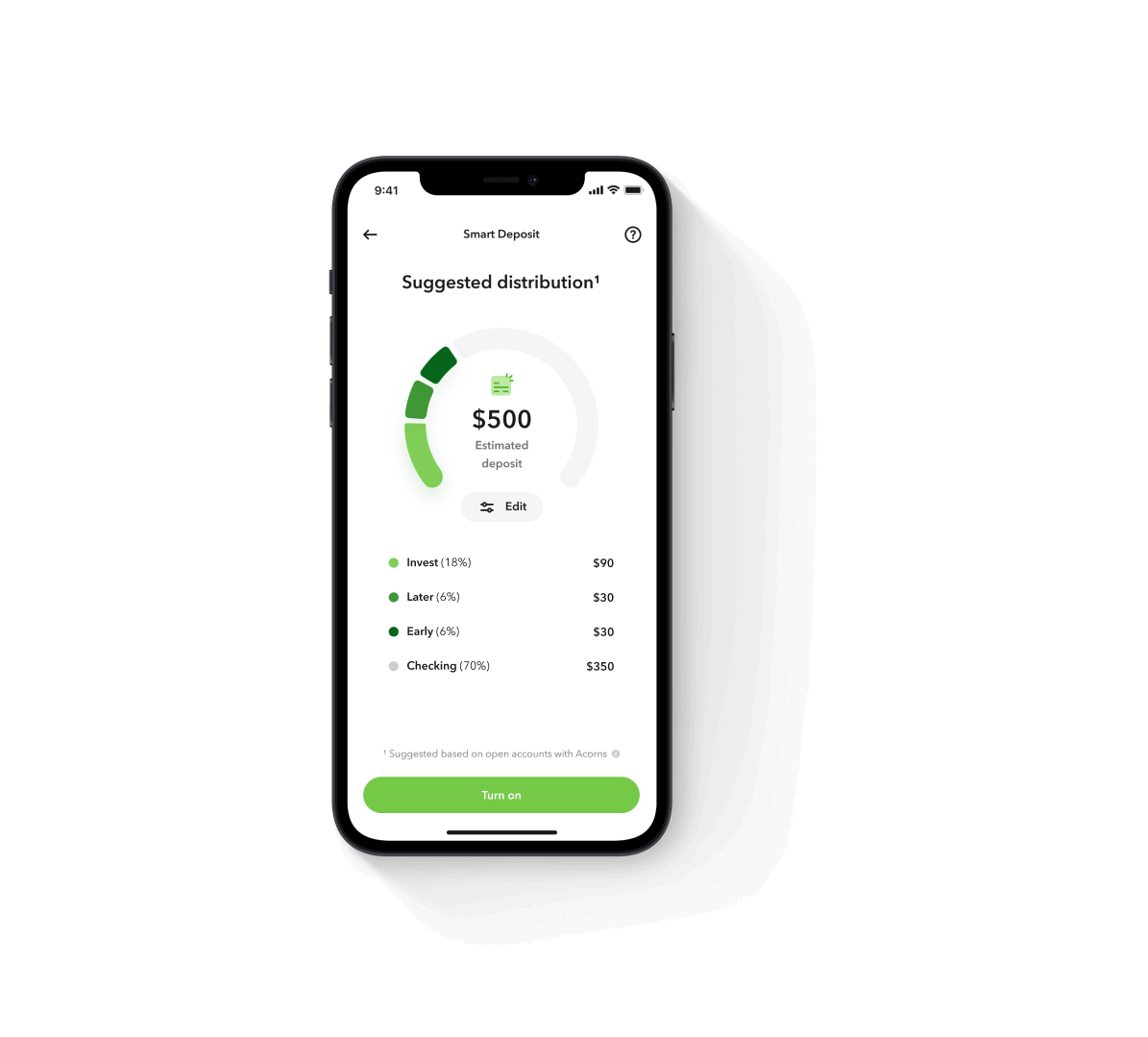

Along with your investment account, you get an easy, automated retirement account, banking that saves and invests for you, bonus investments when you shop with thousands of brands and unique ways to grow your knowledge.

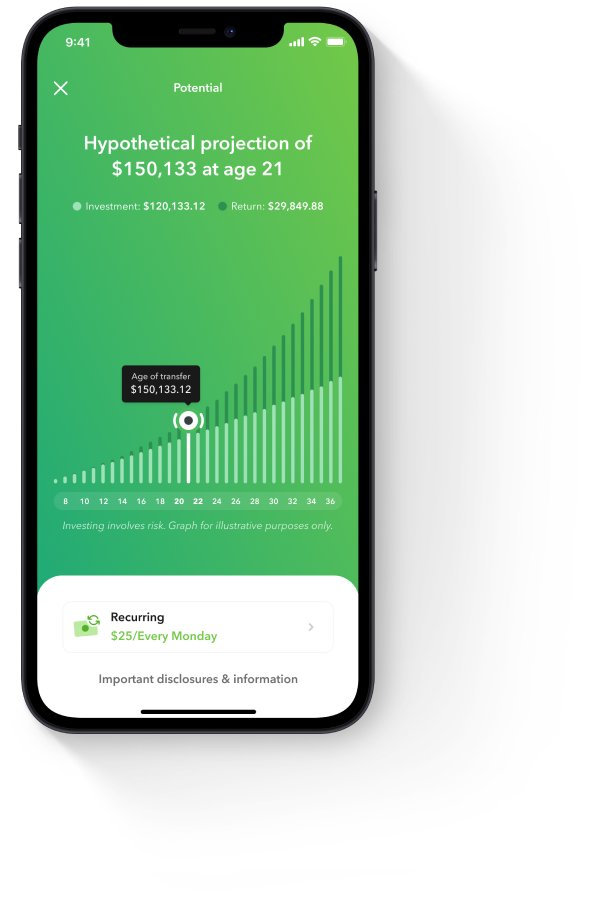

Your Potential is a hypothetical tool that illustrates, how factors such as Recurring Investments (amount and frequency), Round-Ups® investments, Smart Deposit investments, and compound returns may impact the long-term value of an Acorns Account. The tool uses a 6% hypothetical rate of return and hypothetical age range dependent on age band selected by the user. Compounding is the process in which an asset’s earnings are reinvested to generate additional earnings over time. Acorns clients may not experience compound returns and investment results will vary based on market volatility and fluctuating prices.

Money doesn’t grow on trees. But with compound returns, money can grow on itself. It’s a long-term investing principle foundational to how Acorns can work for you.